A strange arrest in Cryptoland

Plus, some news about the impending end of the Crypto Island miniseries!

Hi everybody,

I know it’s been a bit quiet over here.

I’m in production on the final episodes for this season of Crypto Island.

There are a couple more audio stories I want to tell before I close the season, and I’m hoping the story gods will smile on me. I’m tempted to hype these stories up a bit (I think they’re hype-worthy) but it always feels like bad luck to talk about an unbaked cake. I guess I’ll say, I want to wrap up on an ambitious note, and that I’m planning to take Crypto Island international. We’ll see.

In the meantime, you’ll find me in your inbox with newsletters a bit more frequently, mainly to help stave off the deep psychological void inside me that starts to widen when I’m not telling some sort of story on the internet.

Read to the end of this newsletter for more on what’s next for this podcast.

An arrest in Cryptoland

Some fascinating news broke today on Crypto Twitter. Three people were arrested, and the path that got them there started, weirdly enough, with a tweet from this Spring.

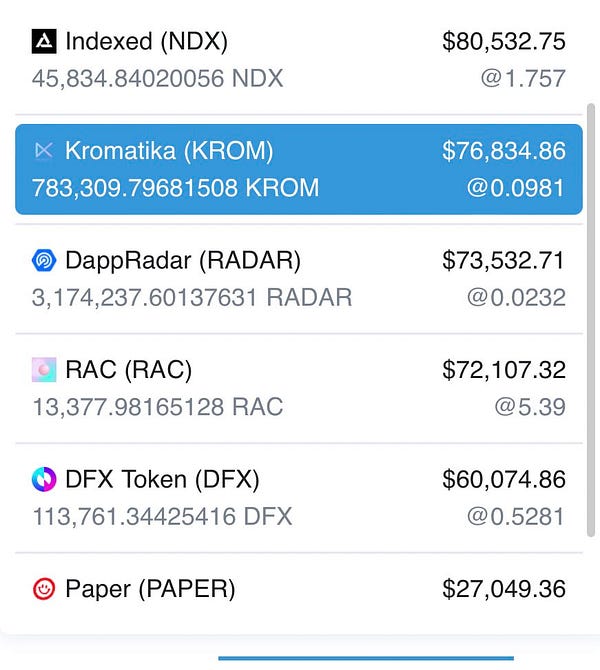

On April 12, one of the bigger accounts on crypto Twitter noticed something unusual:

In case this doesn’t make any sense to you, I can translate a little. For people who daytrade crypto coins, one of the more popular and user-friendly websites is called Coinbase.

It’s sort of like E*Trade but for crypto. And it’s popular. Coinbase onboards a lot of new users into the crypto market. Because of that, when the site decides to add an obscure coin to their listings, that choice to list the coin can be a big deal for crypto markets — it can raise a coin’s price.

Which means, if someone had inside knowledge about what coin was going to be listed next on Coinbase, they could profit off that knowledge, by buying the coin ahead of time.

Of course, on the blockchain, transactions are public.

And Cobie, the person who noticed that this scheme had actually occurred, is someone who studies the blockchain obsessively.

A sidenote to say that Cobie is one of the more fascinating people to follow on crypto twitter — an opinionated, often very funny and very clear writer who is quite candid about his perspective on the all things crypto. Anyway, Cobie noticed in April that someone seemed to be doing exactly this insider play — using some kind of inside knowledge to frontrun coins before they appeared on Coinbase.

So, he posts his tweet. And the next day , Coinbase’s Chief Security Officer responds:

That was April. Today, the arrests were announced. The government alleges that a former Coinbase employee named Ishan Wahi conspired with a relative and a friend to profit off of his inside knowledge about upcoming coin listings. From the indictment:

Based on confidential information provided by ISHAN WAHI , the defendant , NIKHIL WAHI and SAMEER RAMANI , the defendants, collectively traded shortly in advance of at least 14 separate Coinbase public listing announcements concerning at least 25 different crypto assets, and then, in most instances, subsequently sold the crypto assets they had acquired for a profit . These trades collectively led to realized and unrealized gains totaling at least approximately $1.5 million .

The funniest reaction I’ve seen so far has been from crypto traders whose consensus view seems to be that they’re unimpressed with the size of the haul here. One example:

Anyway, these are all allegations, of course.

Although, I will say that Wahi’s reaction when he was told that he needed to come into work for a special meeting seemed relatively suspicious. Again, from the indictment:

…the company's director of security operations emailed ISHAN WAHI , the defendant, to inform him that he should appear for an in- person meeting relating to Coinbase's asset listing process at Coinbase's Seattle , Washington office on May 16 , 2022 . ISHAN WAHI confirmed he would attend the meeting .

After learning that he was going to be interviewed as part of Coinbase's investigation , ISHAN WAHI , the defendant , attempted to leave the United States and flee to India . Specifically, on the evening of Sunday , May 15 , 2022 , the night before his meeting with Coinbase was scheduled to occur, ISHAN WAHI purchased a one - way ticket for a flight to New Delhi , India that was scheduled to depart approximately 11 hours later, shortly before he was supposed to be interviewed by Coinbase. Prior to boarding the flight , ISHAN WAHI falsely told Coinbase employees with whom he worked that he already had departed for India, when in truth and in fact he had not, claiming that he was " out indefinitely" and that his departure was due to a medical emergency involving his father . Approximately thirty-five minutes before his scheduled departure time, ISHAN WAHI wrote to Coinbase's director of security operations that he had to fly back home" but that the meeting could be rescheduled to occur later in the week or early the next week .

In the hours between booking the one - way flight to India and his scheduled departure time on May 16 , 2022 , ISHAN WAHI , the defendant , called and texted NIKHIL WAHI and SAMEER RAMANI , the defendants, about Coinbase's investigation, and sent both of them a photograph of the messages he had received on May 11 , 2022 from Coinbase ' s director of security operations .

Prior to boarding his May 16 , 2022 , flight to India , ISHAN WAHI , the defendant , was stopped by law enforcement agents and prevented from leaving the country . Despite his claims to Coinbase ' ~ director of security operations that he could reschedule his meeting for later that week or early the next 15 week , ISHAN WAHI was traveling on a one - way ticket to India with an extensive array of belongings, including , among other items, three large suitcases, seven electronic devices, two passports, multiple other forms of identification, hundreds of dollars in U. S . currency, financial documents , and other personal effects and items.

Massive amounts of invented internet money are sloshing around daily. I’m sure that if I worked at the company that had inside information about which coins were about to go up, the temptation to profit from that would cross my mind. And every so often, someone succumbs to the temptation.

There was a similar case just last month where an employee at OpenSea (a big NFT marketplace) was arrested for allegedly profiting off of his knowledge about which NFT collections would be going on the front page the next day.

Here’s something I noticed. In their press releases in each of these cases, the government has made a funny sort of boast. The NFT arrest represented the “First Ever Digital Asset Insider Trading Scheme.”

This recent arrest was the “First Ever Cryptocurrency Insider Trading Tipping Scheme.”

The only thing that’s a little funny about those First Ever brags is that in each case, it sure seems like the federal government got wind of an insider trading event because a civilian noticed it first and then tweeted about it.

Unless you think that there’s only been two instances of insider trading in crypto, I would suggest that prioritizing which cases are pursued based off what gets tweeted about might not be an entirely reasonable way to decide where the full weight of the federal government is thrown.

We’re used to newsrooms being run by Twitter, and even corporate PR strategy. It feels a little funny that financial enforcement might happen the same way.

The end of Crypto Island is nigh

But — I’m beginning to sketch out what my next project will be. The plan is to do another series, which you’ll be able to find right here on the Crypto Island feed. What is the series about, you ask? I have an instinct and a suspicion about what the new topic area will be, but I’m keeping my cards close for now.

Alright. More soon.

Thanks for reading,

PJ

for your next topic, you should cover backyard chicken farming; I heard there's a lot of cross-over.

Looking forward to more news on the upcoming project!